IllegalContact

PatsFans.com Retired Jersey Club

- Joined

- Jun 5, 2010

- Messages

- 31,809

- Reaction score

- 16,273

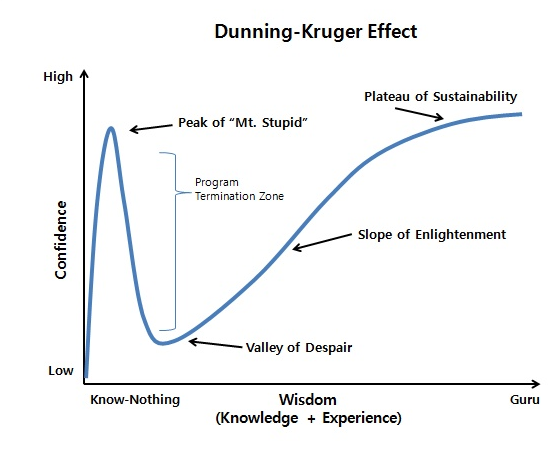

Parents are supposed to do a lot of things that they don’t end up doing. Especially in the hood and the trailer park where the kids are just more money on the government check. It couldn’t hurt to introduce finance classes at an early age to kids. There’s literally zero downside to it. And you can still teach them other useless **** that there’s a massive chance they won’t need to know (such as the mitochondria being the powerhouse of the cell).

lol......nice stereotype there......I think it's worse with the rich folk.....at least the poor get an indirect lesson in what it means to squeeze to make ends meet......some of my kids friends are in their mid 20's and still out to lunch......and no, there's no political demographic to it

schools have personal finance once a week type classes........