lamafist

Rotational Player and Threatening Starter's Job

- Joined

- Jul 26, 2008

- Messages

- 1,197

- Reaction score

- 124

You mean like the housing market or internet bubble companies?

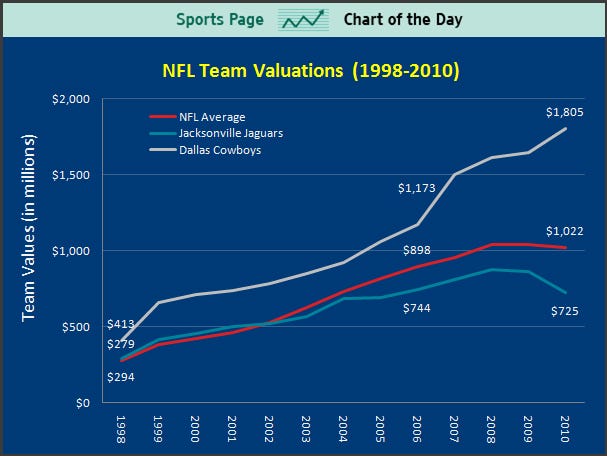

Reality is that values of assets can go up or down. Largely illiquid assets like NFL franchises are typically valued at a combination of Cash Flows and market comparable transactions. If the profitability of a franchise goes down, then guess what? The value goes down. Even if profitability stays even, eventually appreciation will slow or plateau unless new revenue streams are invested in or discovered.

You want to know why franchises continued to grow? NFL Network, Thursday night games, Flexing of games, NFL Sunday Ticket. They went up because the owners were beating down every revenue path they could. Eventually though there is only so much water you can get from a stone.

So you're saying that the NFL's 20 years of sustained, steep growth in popularity and profitability alike, it's tripling in average franchise value in the past 15 years, and sterling track record of revenue stream development is an argument why it's going to suddenly start losing money?

Seriously?